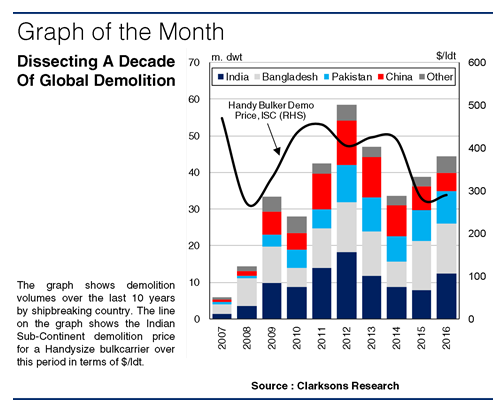

Successful Scrapping Season

2016 was the third highest year on record in terms of tonnage demolished, with a reported 933 ships of a combined 44.4m dwt scrapped. This was a year-on-year increase of 14% and equivalent to 2% of the start 2016 world fleet in dwt terms. Bulker and containership recycling activity was very strong in 2016 and accounted for 65% and 18% of total demolition respectively in dwt terms. The 0.7m TEU of boxships scrapped was 48% higher than the previous peak in 2013, while the 28.9m dwt of bulkers scrapped in 2016 was the second highest yearly total on record. Demolition activity reached firm levels despite continued downward pressure on steel prices from cheap Chinese steel exports. The Indian Sub-Continent (ISC) guideline scrap price for a Handysize bulker stood at $290/ldt at the end of 2016, 28% lower than the end of 2012, when total scrapping peaked.

All Eyes On The ISC

The proportion of tonnage sold for scrap to ISC breakers rose to 79% in 2016, the largest share in the past decade. ISC breaking yards recycled 656 vessels of a combined 40.0m dwt in 2016. Indian breakers experienced a resurgence after a comparatively slow 2015, with 340 ships of a combined 12.5m dwt recycled in 2016. This led their share of total demolition to rise from 20% in 2015 to 28% in 2016 in dwt terms. Bangladeshi breakers saw their share of world demolition decrease from 35% to 31% over the same period. However in dwt terms they still represented the largest share of demolition activity, scrapping 199 vessels of a combined 13.6m dwt in 2016. Recycling volumes at Pakistani breaking yards were steady year-on-year in 2016, with 117 vessels of a combined 8.9m dwt recycled. However, a number of fatal incidents at yards towards the end of the year caused temporary closures.

Sluggish Sino Scrapping

Chinese breakers recycled 111 ships of a combined 4.9m dwt in 2016, 11% of the world total and a year-on-year decrease of 25% in dwt terms. ‘Green’ recycling facilities in China have benefited from the domestic scrap subsidy introduced in 2013, with domestic owners accounting for 87% of tonnage recycled at Chinese yards. However, domestic scrapping fell 31% year-on-year in 2016 to 4.0m dwt. Turkey, another location for ‘green’ ship recycling, scrapped the most vessels of any other nation in 2016, 84 ships totalling 0.9m dwt (2% of global demolition).

Overall, 2016 was a busy year for breaking yards. Indian breakers regained market share and the Chinese lost share as domestic demand fell. Looking ahead, increased pressure to ensure safer and greener ship recycling may have a future impact on the breaker landscape. However, with around 40m dwt currently projected for demolition in 2017, global recycling is expected to remain at elevated levels.